Can the elephant dance is the favored questions doing the rounds relating to the HDFC – HDFC Financial institution merger. Elephants are attribute of being protecting, with one foot all the time on the bottom. They’re alert and regardless of the scale, are quick runners. Submit the merger, the mixed entity might possible take these qualities of an elephant, if not be recognized for the dance. At Rs 18 lakh crore of mortgage guide, HDFC Financial institution might stay an unmissable inventory within the portfolio. However forward of the merger, listed below are 4 crucial bins to verify.

Shareholders’ technique

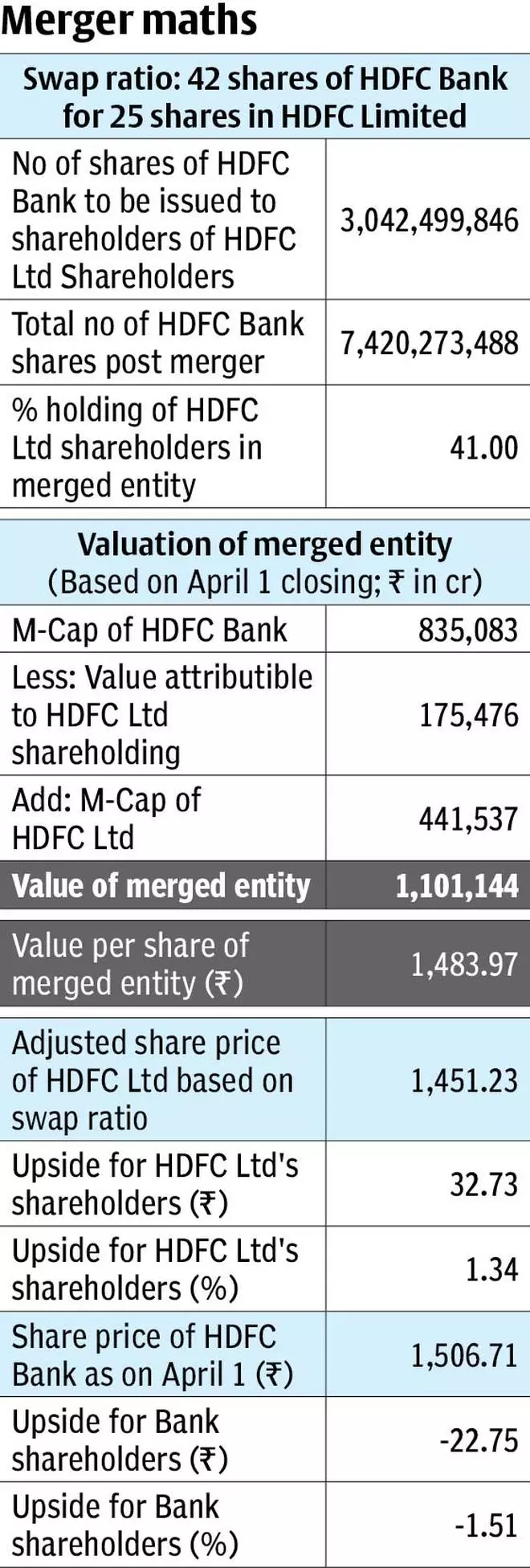

Shares of HDFC Ltd and HDFC Financial institution get pleasure from huge reputation amongst all classes together with retail buyers. Submit-merger, HDFC Financial institution inventory’s weightage in Nifty is about to extend to 14 per cent from 8.43 per cent. So, first verify on a mixed foundation how heavy is the HDFC Financial institution inventory in your portfolio. If the burden is an excessive amount of, you run the danger of placing all of the eggs in a single basket. If not, you could be inclined to extend the publicity following the merger information. In that case, buyers may take into account shopping for shares of HDFC Ltd, because it affords higher upside over the financial institution’s inventory on a consolidated foundation (see desk).

What if you’re already holding HDFC Financial institution shares? Then, utilising the merger upside could possibly be clever. Exit your place in HDFC Financial institution and purchase shares of HDFC Ltd. In the event you maintain each the shares however there’s room to extend the holdings, purchase shares of HDFC Ltd. As for the financial institution’s shares, you may proceed holding them. However if you’re inclined to take a tactical name, promoting shares of HDFC Financial institution and rising the place in HDFC Ltd is an possibility. Please be aware that is an illustrative advice. Issue within the tax legal responsibility and incidental prices whereas taking the choice.

Additionally, each shares are broadly held by home and overseas institutional buyers who’re sure by the ten per cent cap on single inventory weightage of their portfolio. Therefore forward of the merger, fund homes might prune their stakes, which may hold the shares underneath stress. This rebalancing has began enjoying out and partly explains why the 2 shares pared most of April 4’s single day features over the course of the week.

Additionally be aware, HDFC Restricted persistently has supplied larger dividend in comparison with the financial institution. Common dividend yield of HDFC Financial institution since FY16 works out to a couple of per cent. Its over 4 per cent for HDFC Restricted throughout this era, as till FY19 it paid dividend twice a 12 months. Gear up for a reset in dividend pay-outs.

Who features extra

On the face of it, the merger appears to be a win-win.

HDFC Restricted will get wider entry to banking merchandise which might assist retain buyer. For HDFC Financial institution, the share of housing loans will improve from 11 per cent to 33 per cent of its complete mortgage guide. With this, a significant criticism about its retail guide being skewed in direction of unsecured loans might be addressed. However there are equal measures of ache.

A a lot older housing finance enterprise folds into the financial institution and HDFC Restricted’s operational autonomy might cut back or vanish to adjust to the financial institution’s type of functioning. HDFC Restricted’s rate of interest is larger in comparison with trade’s 6.45 – 6.5 per cent all-time low charges. Even when the speed cycle reverses by the point the merger fructifies, HDFC might not have its freehand in pricing loans if it ought to keep aggressive available in the market. Likewise, the stickiness of HDFC Restricted’s Rs 1,50,131 crore of deposits (in FY21) might be examined when it’s built-in with the financial institution which might provide a lot decrease charges on its deposits.

For HDFC Financial institution, which holds a report for sustaining its internet curiosity margin (NIM) at 4 per cent or extra since 2014, the direct implication on profitability is unavoidable. House loans carry NIM of three.6 per cent and therefore the belongings rebalancing will weigh on HDFC Financial institution’s profitability.

Subsequently, there’s achieve and ache for each within the merger. On one hand, HDFC Restricted will cede its jewel crown constructed over years, whereas HDFC Financial institution will hand over on its profitability, which has been its USP.

Regulatory tangles

If HDFC Financial institution’s mortgage guide will increase to ₹18 lakh crore from ₹12.7 lakh crore (as on Q3 FY22), the necessities for precedence sector lending (PSL) will even go up. Within the preliminary years post-merger, the financial institution may dip into PSL bonds to shore up this guide. This might impression the financial institution’s carrying price of funds by two per cent yearly. There are additionally statutory reserves – money reserve ratio and statutory liquidity reserve ratios to keep up, burden of which can be ₹70, 000 – 90,000 crore. All put collectively, a compression in HDFC Financial institution’s NIM by 100 – 125 foundation factors appears possible.

Subsequent, there’s the tough query round RBI’s consolation in permitting the financial institution to function non-bank subsidiaries. Regulator’s stand on this facet has been very subjective. Whereas ICICI Financial institution must prune its stakes in its insurance coverage arms to 30 per cent, Axis Financial institution didn’t get a go-ahead to carry 30 per cent stake in Max Life Insurance coverage. It was allowed to carry solely 10 per cent. RBI’s consolation with HDFC Financial institution holding 50 per cent or extra stakes in insurance coverage arms (life and normal) and NBFC companies submit the merger is unclear. If stakes are to be hived off as a prerequisite to the merger, that will put stress on the shares of HDFC Life and HDFC AMC. But when HDFC Financial institution ought to prune its stake post-merger, it could be a blessing in disguise.

In FY17 – FY19 if ICICI Financial institution and SBI didn’t elevate capital regardless of the necessity that arose as a result of asset high quality pressures, IPOs/ stake sale throughout subsidiaries helped. Likewise, subsidiaries could also be advantageous quite than a burden for HDFC Financial institution, although the holding firm low cost on the inventory may improve from the current 5 per cent degree.

What to anticipate

Within the Huge Story of Portfolio version dated March 20, we advised you ways the HDFC group firms, together with the financial institution and housing finance arms are set for a slower tempo of development. One of many contributing elements was the guide sizes changing into bigger than earlier than. With the merger set to conclude by FY24, the merged financial institution might have an asset measurement of ₹20 lakh crore(factoring for six – 8 cent CAGR development in FY23 – 24), putting it second to SBI in steadiness sheet phrases. It’s mortgage guide could be round 8.5 per cent of India’s estimated GDP. Banking as sector is a play on the nation’s financial system. Subsequently, an total financial slowdown gained’t spare HDFC Financial institution.

Additionally, HDFC Financial institution together with SBI and ICICI Financial institution are labeled as banks ‘too giant to fail’. With this tag, comes higher regulatory oversight. Till now, HDFC’s residence loans, schooling loans and investments held underneath HDFC Restricted weren’t subjected to shut supervision. That may change.

However the good half is hassle in a single section – say agri, auto or SME loans might not have an exaggerated impression on the general guide due to mortgage guide variety. Count on the mortgage development and asset high quality to be at a gentle charge. Submit merger, buyers ought to deal with HDFC Financial institution inventory like a secure haven inventory . Count on regular returns, mimicking the Nifty or Sensex. In any case, its a charge sight to see the elephant dance!

Printed on

April 09, 2022