da-kuk

On the subject of investing, I focus virtually completely on long-term fundamentals. I wish to purchase firms and different property with time horizons of 3-5 years, and even longer if doable, and allow them to compound over time.

Nevertheless, focusing on some fundamental technical indicators might help with threat administration. When doable, I like to purchase high-quality property that not too long ago fell sharply and have proven some semblance of a backside, marked by a momentum shift from damaging to optimistic, for instance.

That after all doesn’t assure {that a} backside is in, and will all the time get a decrease low, however these forms of alternatives are not less than good to pay attention to for additional analysis.

A number of occasions per 30 days for Inventory Waves, I attempt to discover alternatives the place the basics and technicals align and publish a short-form piece on them. Zac and Garrett give attention to technicals solely, and I give attention to fundamentals solely (or 95%), and so I am going and discover shares that we’re all bullish on for various causes, or all bearish on for various causes, and see what’s happening there.

Lyn Alden

I wish to make a few of the items on this sequence public sometimes (not simply in Inventory Waves), so right here’s this week’s version of “The place Fundamentals Meet Technicals”, with the purpose of offering a watch listing of names which might be value digging extra into.

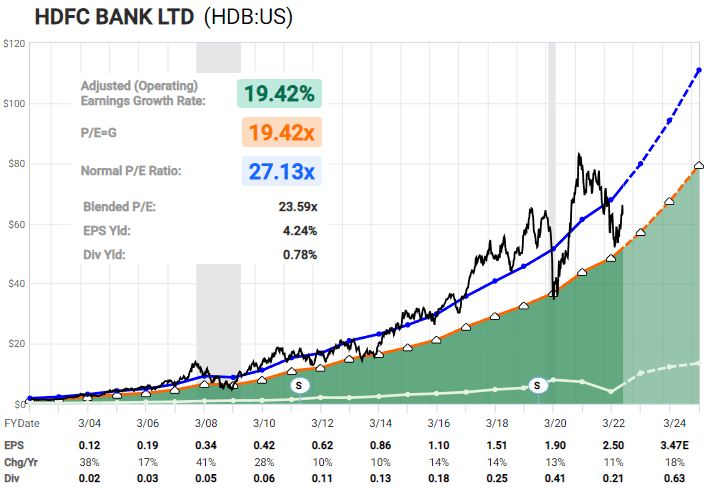

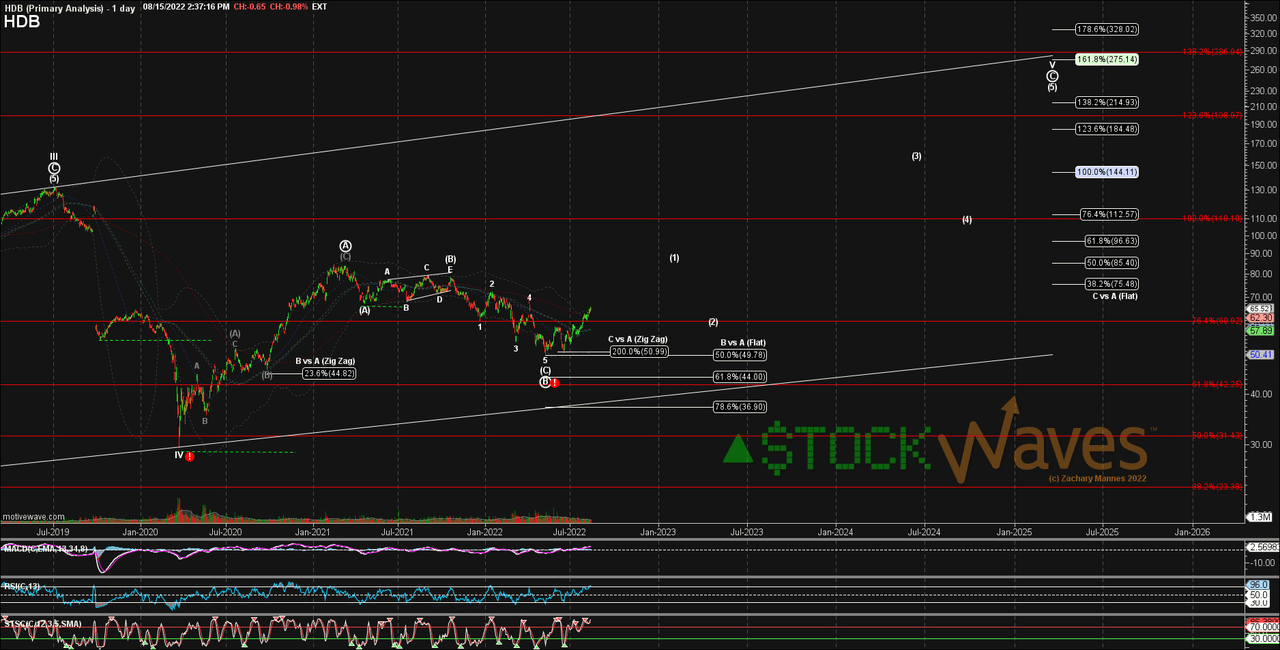

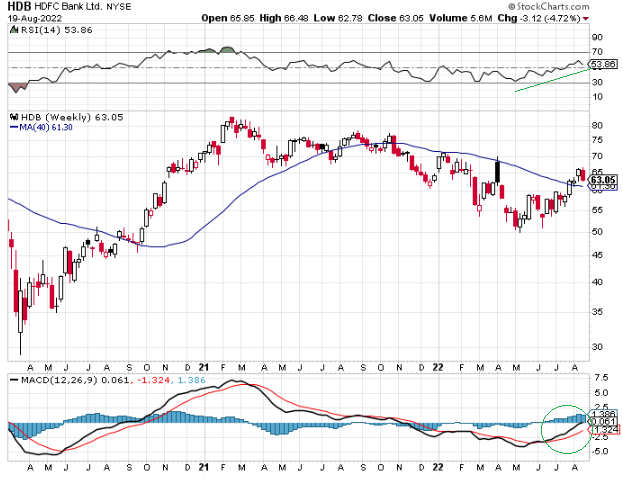

HDFC Financial institution

HDFC Financial institution (HDB), the biggest financial institution in India, is fairly attention-grabbing at present ranges.

FAST Graphs

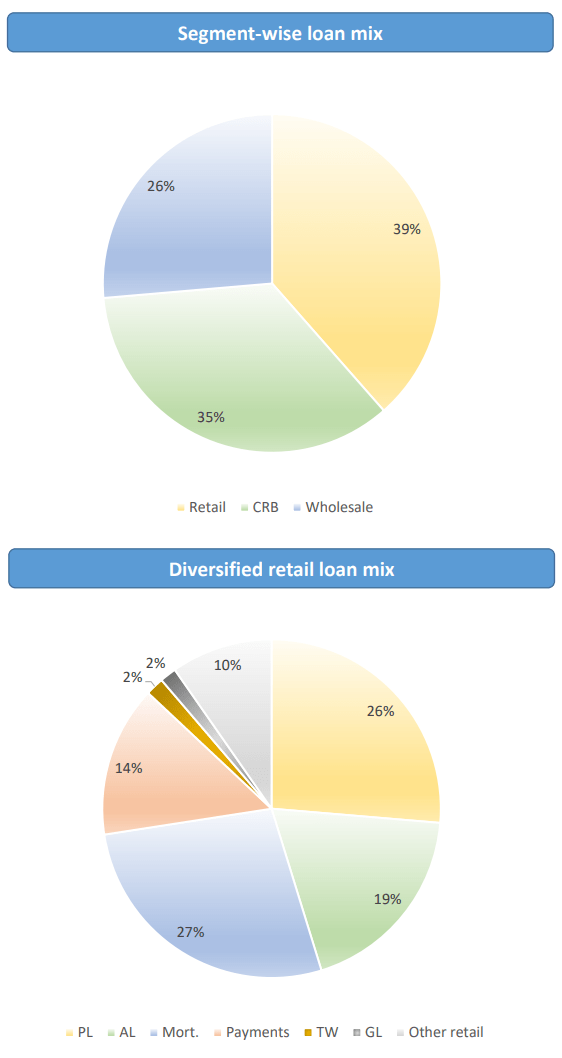

The financial institution has a persistent double-digit development charge, and a valuation that whereas considerably wealthy in absolute phrases, is at present fairly affordable relative to its lengthy historical past. Moreover, the financial institution is well-capitalized, with good inner metrics, and has a really diversified mortgage e book.

HDFC Financial institution 2022 Investor Presentation

Moreover, HDFC Financial institution’s upcoming merger with HDFC Ltd will additional diversify the financial institution to extra forms of monetary merchandise.

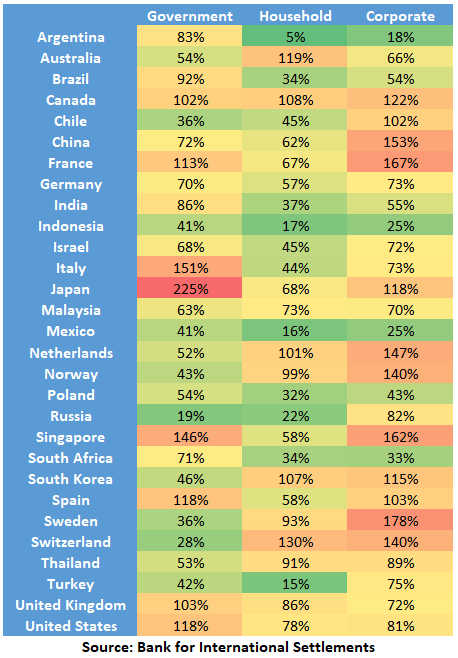

India stays underbanked generally, with solely 37% family debt as a share of GDP.

Financial institution for Worldwide Settlements, Lyn Alden

With favorable demographics, and low home and overseas debt, I proceed to have a long-term bullish outlook on India generally, and India’s banking sector particularly.

Independently, Zac has been figuring out HDFC Financial institution as a bullish technical alternative over the following few years.

Zac Mannes

For a place buying and selling perspective, an investor may use the Could 2022 low as an invalidation or re-assessment degree relating to the bullish thesis, and in any other case let it run to the upside if it stays above that threshold.

StockCharts

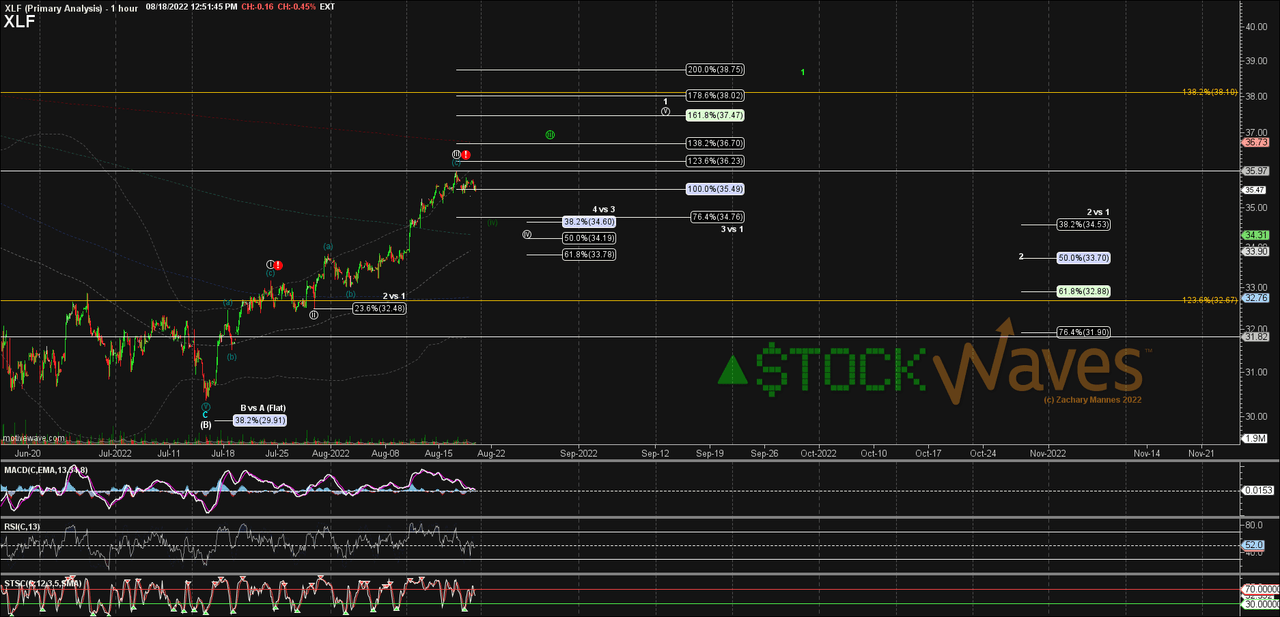

US Monetary Sector

Banks in the US have a lot slower development than HDFC Financial institution, however additionally they commerce at low valuations. Lots of them, as a consequence of present recession fears and an inverted yield curve, commerce at single-digit worth/earnings ratios, or almost so.

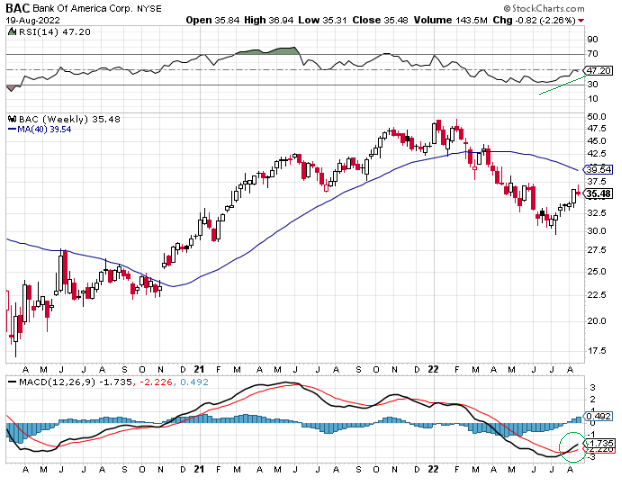

Zac has been bullish on the monetary sector these days for technical causes, and it strains up with how I view them basically.

Zac Mannes

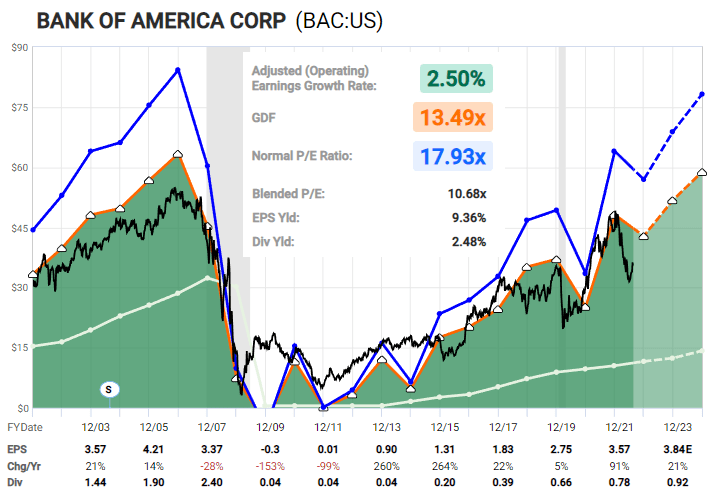

If we take Financial institution of America (BAC) for instance, we will see how sharp this latest sell-off was:

FAST Graphs

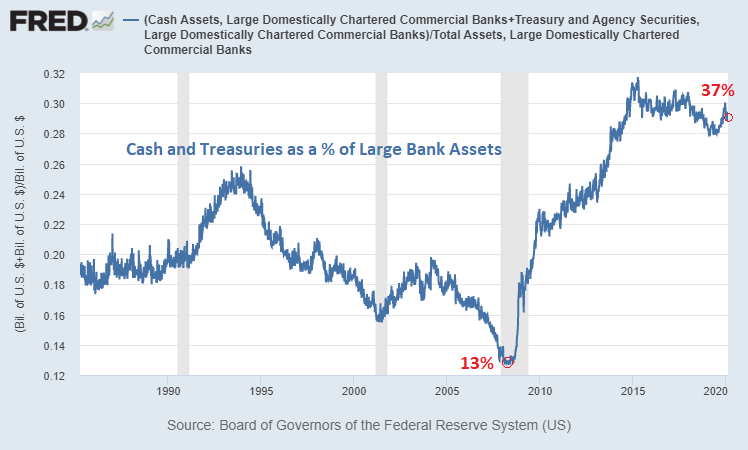

Not like the 2007-2008 interval, banks within the US have very excessive ranges of money and Treasuries as a share of their property, and loads much less publicity to subprime lending, which makes it loads much less possible for them to have cataclysmic lending losses.

St. Louis Fed

Whereas acknowledging their cyclicality (aka loads of near-term volatility on this decelerating economic system), I proceed to be bullish on good US banks with a multi-year view.

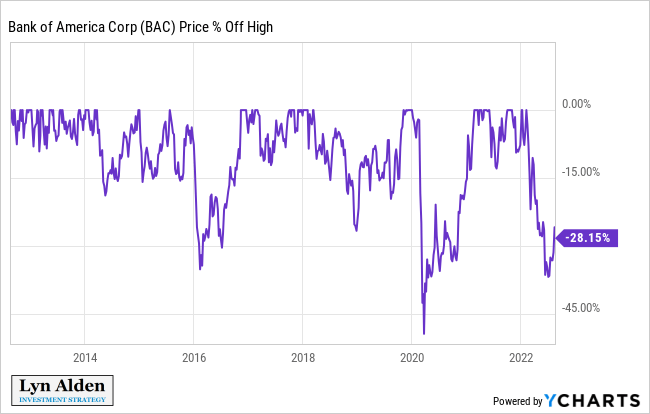

This latest sell-off in BAC has already been its third-worst inside the previous decade, with a peak drawdown of about -37% again in July, from ranges that weren’t that top to start with:

YCharts

I feel it is going to be uneven waters for banks for fairly a while, however when trying again 3-5 years from now, I feel the chances are at present of their buyers’ favor.

StockCharts

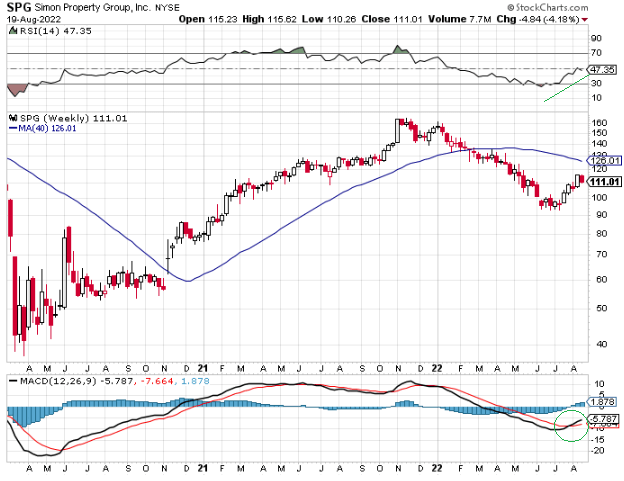

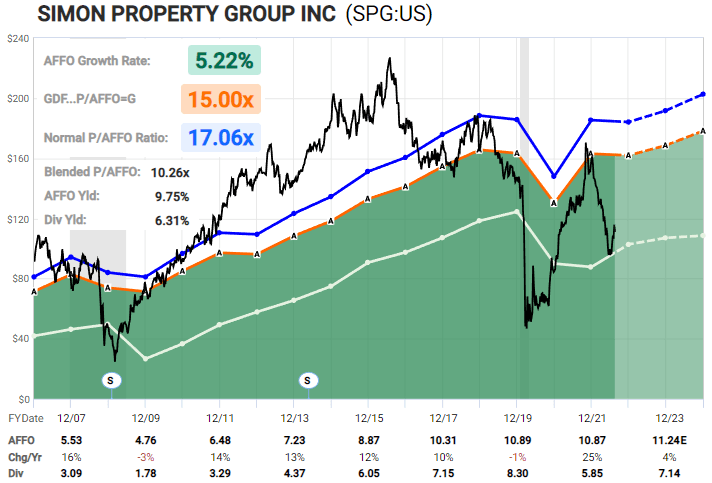

Simon Property Group

Many REITs have taken a beating these days, together with a few of the high-quality ones like Simon Property Group (SPG).

FAST Graphs

With an A- credit standing, SPG has ok money flows and steadiness sheet flexibility to climate a recession. SPG is extra cyclical than some others like Realty Earnings (O), however in trade for that, SPG is buying and selling at a traditionally low AFFO a number of, whereas names like Realty Earnings are usually not.

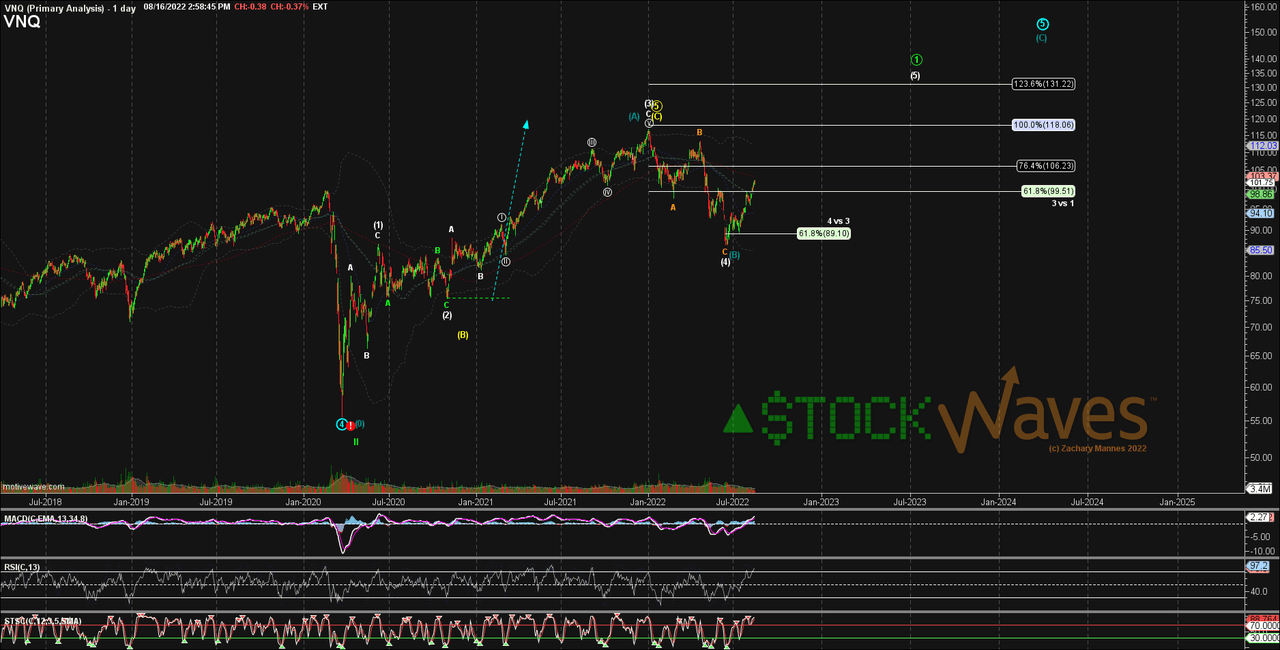

Zac has had a constructive outlook on REITs (VNQ) in a technical sense ever since they hit this latest native backside:

Zac Mannes

For threat administration functions, Garrett recognized $116 as a technical resistance worth degree to look at for SPG again in July. He considers it much less dangerous as soon as it breaks above that degree, and SPG not too long ago bounced proper as much as that degree and rolled over.

For now, buyers would possibly wish to sit again, keep away from catching any knives, and watch this play out. But when it breaks again above $116 to proceed this latest rally, then each basically and technically, it turns into a really attention-grabbing setup.

StockCharts